Published Jul 29, 2018

Automating the Application of Incoming Customer Payments

Today, many companies still perform the application of customer payments using highly manual processes. This process involves someone in accounting manually entering the incoming payments into NetSuite and then applying those payments against open invoices. If there are any discrepancies (for instance if an invoice number doesn’t match, the customer name doesn’t match, or the invoice amount doesn’t match), this person has to spend additional time investigating the discrepancy and correcting for it. And, because a human-being is performing all of this work, it’s possible that they may introduce even more errors into the process, requiring even more time for investigation and correction. And, according to Murphy’s Law, this time-consuming chore will most likely happen during the closing cycle when you can least afford delays.

For growing companies or companies with large numbers of incoming payments, this manual and potentially error-prone process is costly and unsustainable.

Matching customer payments in NetSuite

It’s probably not a surprise to you that customers want and expect flexibility in their payment options. Providing these options means there are multiple ways that payments can come into your bank, including checks, Wire Transfer, ACH, etc. And, somehow, these payments need to be transferred to and captured in NetSuite.

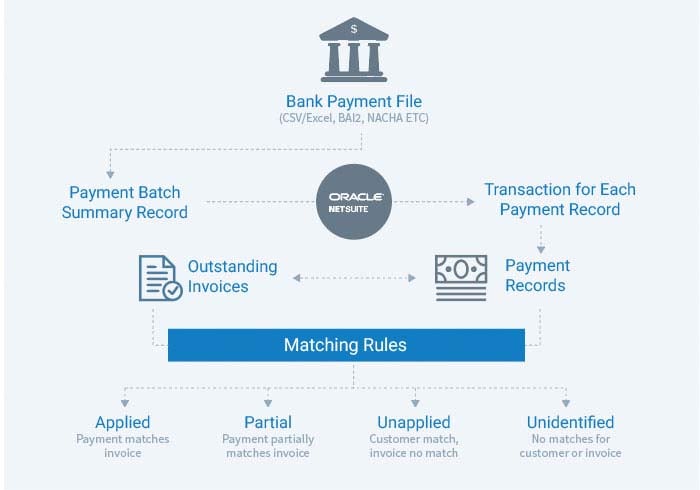

An ideal process for handling all of these payment types would be for your bank to create a payment file, or payment batch summary record, that is automatically and securely transmitted to and decrypted in NetSuite for processing. This bank file would provide relevant customer and invoice information associated with each payment, and the payment would then be stored as a searchable NetSuite record. And, all of this would happen without the need for human intervention.

Because you have defined business rules that specify what should be done based on pre-defined matching rules, these customer payment records would be matched and applied automatically within NetSuite.

Matching RulesAutomating Application of Customer Payments

Matching Rules

Unfortunately, customer payments are not always straightforward, and sometimes payments cannot be matched and applied immediately; for instance, if the customer name and amount on an outstanding invoice don’t match exactly what is on the payment record. In these cases, your ideal process would allow you to create some customized matching rules that take action to reconcile unmatched payments (i.e., exceptions). These matching rules would be defined and built based on your company’s individual needs.

Your integration tool would then run these exceptions through the customized matching rules with the goal of reconciling as many as possible, automatically.

Any exceptions that are left after all matching rules have been run would then be listed in an easy-to-read dashboard that gives your cash application team the ability to drill down to view statuses and resolve errors. The dashboard would also update instantly and provide feedback as the team works through and fixes the issues.

In summary, banking integration for your accounts receivable flow should offer:

- Secure and automated receipt of customer payments from your bank to NetSuite

- Conversion of the bank payment record into easily searchable transactions in NetSuite

- Flexible and customizable payment matching rules that allow you to define what is a match and what action should be taken, and when

- Automatic application of these rules to outstanding invoices

- Presentation of exceptions in an easily understandable dashboard

- Ability to easily review and remedy exceptions

For your accounts receivables solution, your goal should be to automate your processes to eliminate the manual work involved with matching payments to invoices. This automation not only reinforces internal controls but also eliminates errors and allows you to reallocate the human resources that are no longer needed for payment processing to other areas of the organization that will provide more value to your business.

Celigo Cash Application Manager

To automate your Accounts Receivable process, you first need a solution that allows you to safely and securely integrate your bank with your NetSuite application.

The Celigo Cash Application Manager is that solution.

The Cash Application Manager includes an easy-to-read dashboard that allows you to monitor the status of all payments.

The Celigo Cash Application Manager is a pre-built, out-of-the-box integration solution that securely connects NetSuite and your bank. This connection allows your bank to transmit payment information made via lockbox, wire transfers, or ACH to NetSuite. These payments are converted into NetSuite transactions and automatically applied against open invoices in NetSuite.

Business Rules Engine and Monitoring

Cash Application Manager provides pre-configured business rules that tell it how to apply each payment. It also provides you with the means to create your own customized matching rules that tell it how to handle each payment and any discrepancies found, based on your company’s individual needs.

The Cash Application Manager includes an easy-to-read dashboard that allows you to monitor the status of all payments. This dashboard displays the number of payments that have been fully applied and highlights those transactions that caused exceptions and that need attention.

And, as you work your way through these exceptions, the Cash Application Manager dashboard provides instant feedback by moving the transactions into the “Applied” category as they are corrected.

Key features of Celigo Cash Application Manager include:

- Payment records are automatically created in NetSuite

- Payments are automatically applied against open invoices

- Flexible business rules engine to define custom or update existing matching rules

- Visual dashboard to quickly see the status of payments

- Install and configure pre-built integration with no IT support

- Supports consolidated and single invoices

Learn more about how to gain efficiencies, reduce DSO, and increase visibility by automating cash application in NetSuite.