Published Jul 9, 2020

What is Cash Management and How Does it Evolve as Your Company Grows?

Defining Cash Management

From the broader business perspective, cash management describes everything your company does to generate and use cash. For example, business teams might ask, “How will we preserve cash in uncertain times?” For your controller and accounting team, cash management is more operational. It’s the process used to provide management teams with the most timely and accurate cash reports, and it includes all the execution necessary to feed those reports, including making payments, collecting receivables and preparing SEC cash flow statements.

Over your company’s lifecycle, your cash management processes will necessarily change. Younger companies have simpler reporting requirements because they are not required to report to the SEC. Nor do executives from startups need to review their cash reports frequently; they may simply look at cash reports once a quarter when they hold board meetings. As your company matures and becomes publicly traded, it must not only create cash reports that meet SEC requirements, it must also update them frequently. For example, in the last week of a quarter, CFOs of larger companies constantly ask questions about cash collection status or payments set to go out to ensure they’re meeting cash flow objectives.

Cash management also differs from industry to industry. The type of customers a business has will impact the nature of receivables and the ability to report and collect them efficiently. For example, an eCommerce shop that sells directly to customers may receive payments from Stripe or other similar banking solutions. In contrast, a bigger B2B company can have large invoices with numerous variables. Such dynamic invoicing and pricing present greater risks in terms of reporting and timely collections.

Cash Management Solutions Vary Widely Throughout the Company Lifecycle

Given these differences in cash management and reporting requirements, it’s not surprising that the processes and technologies companies at different phases of maturity use to perform cash management and reporting vary significantly as well.

On the receivables side, companies often start by issuing invoices and performing collections manually. Many even forego collections activities altogether due to lack of resources. They may also get information from the bank and record it manually in QuickBooks, Xero or some other early stage accounting system. As the organization matures and gains more resources, it may invest in a solution that enables greater automation of the billing and collection cycle, such as Xero or YayPay.

The same is true on the payables side. Newer companies often receive invoices from vendors by email, key invoices into their system of record, and then send out payments by printing checks or initiating batches manually. In contrast, more established companies may employ solutions like Coupa, Concur or Bill.com to automate the process. They may require vendors to log into a portal to submit their invoices, and then perhaps connect to the bank and tee up batches of checks to simplify payment processes and improve reporting. A closed management system like BlackLine or FloQast can then tie those point solutions together in an accurate and timely fashion to create reports for management decision making.

Staffing and Automation for Effective Cash Management

When staffing accounting teams, earlier stage companies usually have fewer resources–and process fewer transactions–on the receivables and payables side than their larger counterparts. Staff may also wear multiple hats, performing AP/AR and payroll tasks.

As organizations grow, their ability to control headcount depends on how well they automate processes. I’ve found that its more time and cost efficient to invest in technology earlier in the lifecycle, rather than hire a large team and then determine what automation solutions to implement.

Collections is a good place to begin your automation journey because the ability to generate cash from sales is what enables your business to grow. Not only does automation ensure that accounting teams can process receivables and make collections efficiently, it also gives business owners, managers, and executives greater visibility into receivables for better decision making.

I should note that there have been relatively few innovations in collections technology when compared with the payables side. I do like Dunning, which sends collection notices. And cash collections solutions are now available that can interact with customers to provide ETAs on payment dates. Business owners or managers can gain considerable value from understanding when they’ll get cash back from the invoices they’re generating and using that information in business planning.

Where Gappify Fits In

Gappify helps businesses further automate AR/AP processes. It sits inside your ERP system and automates activities that a human would normally perform. We’ve identified more than 500 tasks that we can automate. For example, if a company sends an invoice to a customer, we have a business rule that reaches out to the customer after two days to make sure that they got the invoice and that the sales tax is correct. All of that is baked into our platform. We work with customers to configure the system to their use cases.

The Role of Integration

Integration is foundational for your company’s ability to use all of these AR/AP systems to meet business goals.

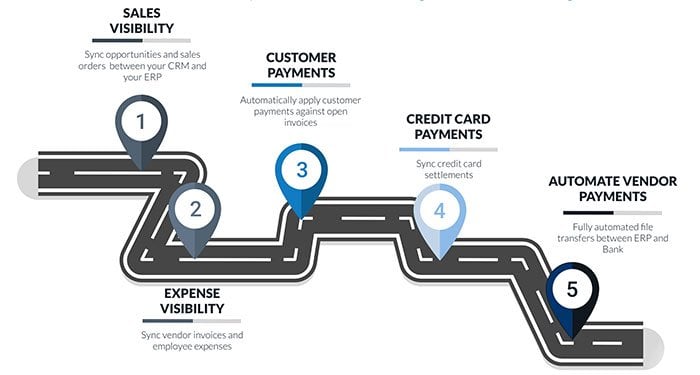

Fifteen years ago, everyone thought most companies would use one system like Oracle or SAP for all their cash management requirements. But the best of breed approach won out. An ERP system now serves as most organizations’ system of record, but each business unit selects the point applications that best meet their business needs. Because companies have multiple applications, they have accounting tech stacks that must talk to each other to make sure data is accurate in the ERP. All those interactions happen in real time or frequently enough that management teams can see timely reports.

iPaaS solutions like Celigo do a great job of bringing those two worlds together.

One key consideration is that when your business users pick a tool, such as expense reporting tool, you have to balance the needs of both the business users and the accounting team. The business users want something that provides the capabilities they need and is easy to use. The accounting team wants to make sure the data on the front-end meshes with their back-end accounting processes. The only way to satisfy both teams is with strong integration solution that enables accounting to capture the data they need in a very clean manner. iPaaS solutions like Celigo do a great job of bringing those two worlds together.

Cash management processes must grow and change along with your business. And as your business matures and evolves, you’re likely to increasingly automate cash management processes. If you’re like most organizations, you’ll perform this automation using best of breed solutions, which means you’ll need to integrate your point cash management solutions. For more information on how to evolve your cash management processes to improve efficiency and cost effectiveness, listen to our Order-to-Cash podcast with Gappify or check out our webpage below to learn about our cash management solutions.