Financial reporting automation: A strategic guide for finance leaders

A recent study found that 58% of business leaders have made significant decisions based on outdated or incorrect financial data. Since financial agility is now a key competitive advantage, this is a clear strategic liability.

Manual financial reporting processes create delays in strategic decision-making. Disconnected systems result in data silos that undermine reporting accuracy, and finance teams spend valuable time gathering and reconciling data. This all causes significant delays on their ability to provide strategic guidance for quick decision-making.

This post explores how financial reporting automation ensures you have accurate, actionable data to make the best strategic decisions.

What is financial reporting automation?

Before diving into the challenges and solutions, it’s important to understand what financial reporting automation actually means and how it differs from traditional manual processes.

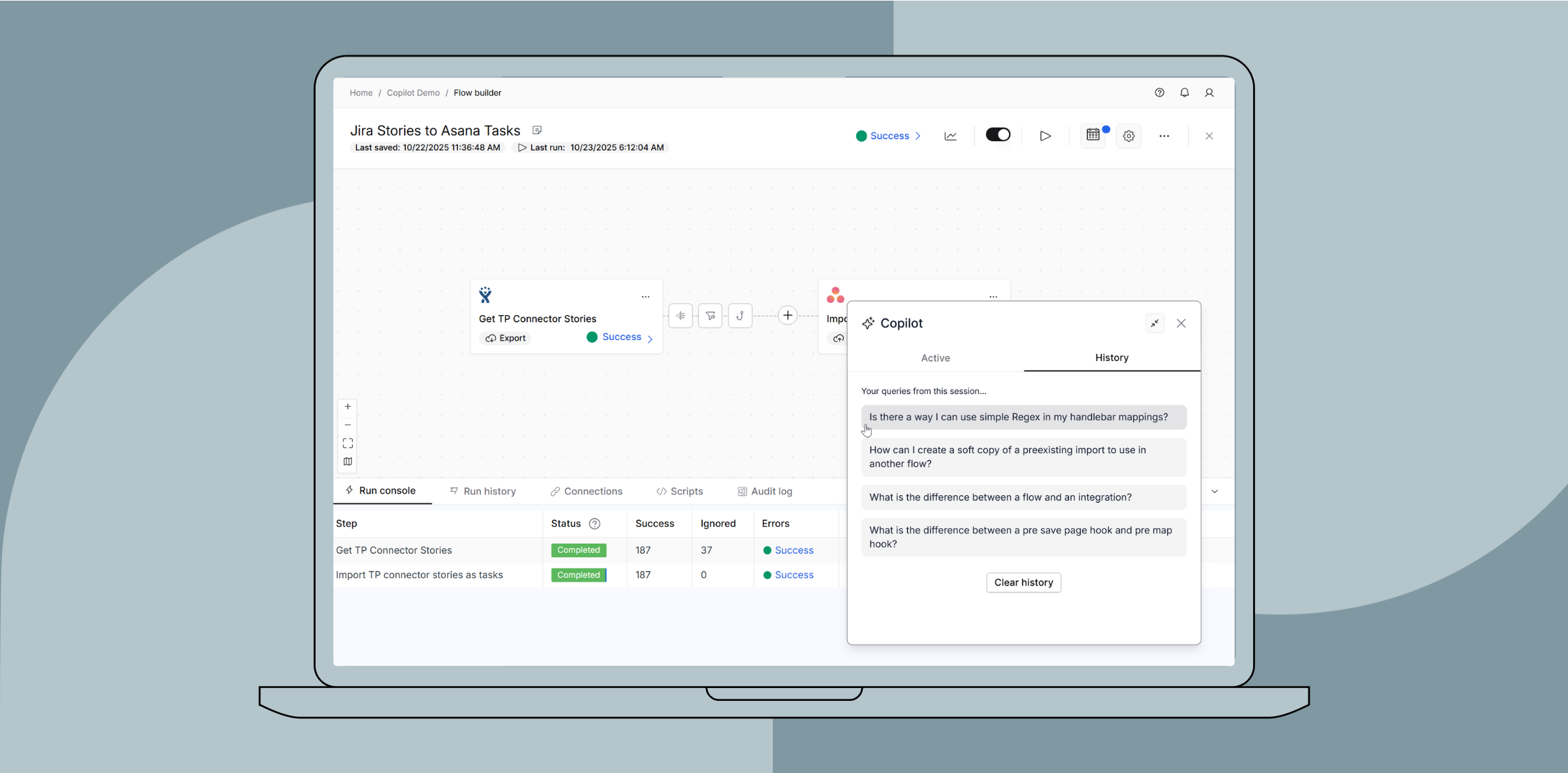

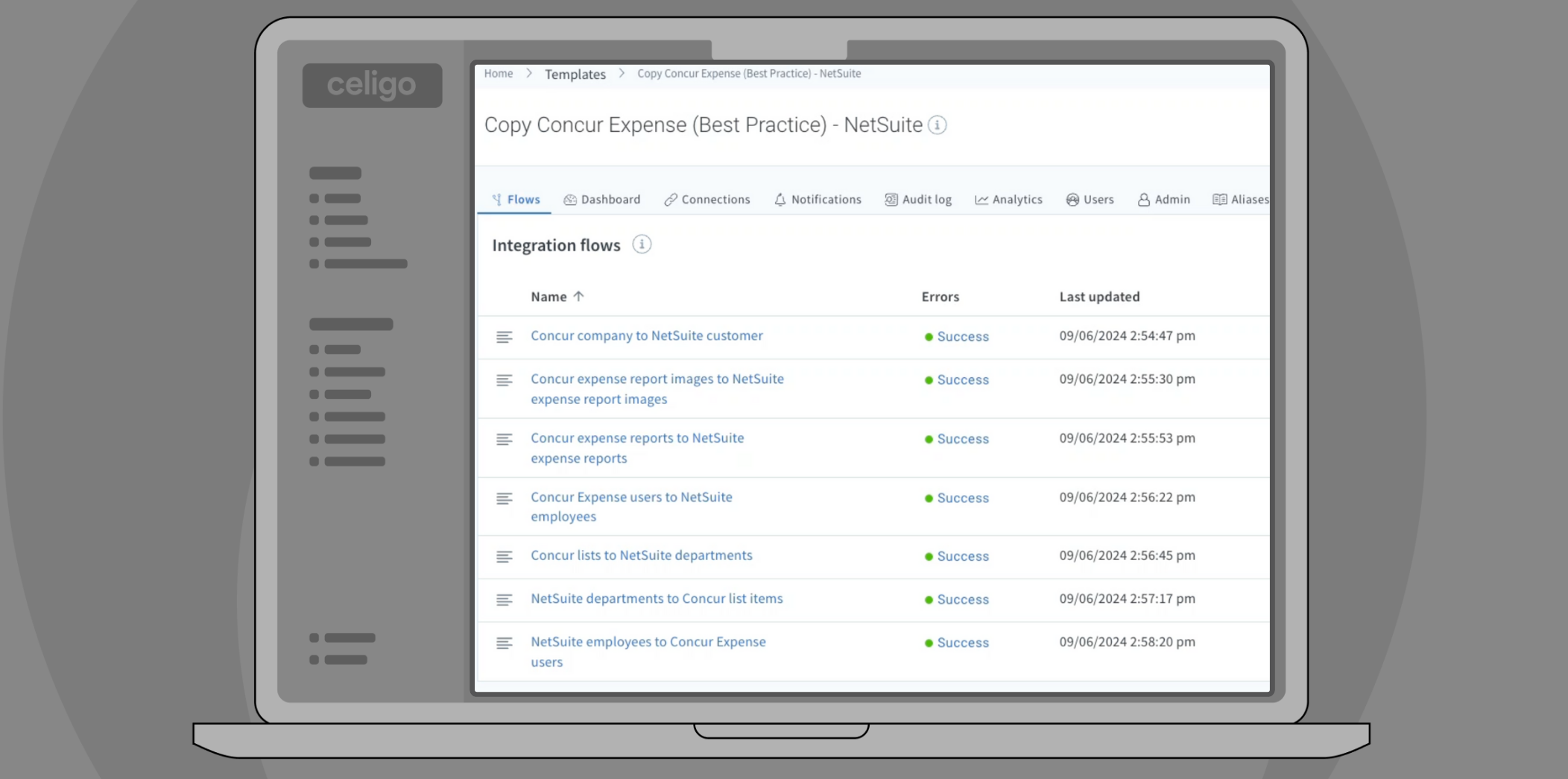

Financial reporting automation uses iPaaS platforms to connect disparate financial systems like your ERP, CRM, billing, or revenue recognition software. This enables real-time data synchronization and automated report generation.

The traditional approach for financial reporting included:

- Manual data exports from multiple systems

- Spreadsheet-based consolidation and reconciliation

- Static reports created on monthly or quarterly cycles

- Finance teams spend 70% of time gathering data versus analyzing it

The automated approach includes:

- Continuous data flows between integrated systems

- Real-time validation and transformation

- Automated report updates as transactions occur

- Finance teams focus on analysis and strategic decision-making

The key difference: This goes beyond simple task automation to orchestrate complex, multi-system workflows with business logic, validation rules, and compliance controls.

The current state of financial reporting challenges

To understand why automation matters, finance leaders first need to recognize the specific pain points that plague manual reporting processes. These challenges fall into three categories, each creating compounding effects on business performance.

1. Data collection bottlenecks

Finance teams collect data from multiple sources, including their ERP, CRM, billing platforms, and revenue recognition systems.

Manual processes involve time-consuming exporting, transformation, and consolidation processes that are prone to human error. And by the time the data is compiled, it may already be outdated.

Impact on business:

- Delayed decision-making based on stale information

- Limited ability to respond to market changes or capitalize on opportunities

- Finance teams are stuck in operational work rather than strategic analysis

2. Data accuracy and consistency issues

Each system maintains its own version of financial truth. Manual reconciliation introduces human error, and inconsistent data definitions across platforms lead to reporting discrepancies that undermine confidence in the numbers.

Impact on business:

- Loss of confidence in financial reporting among leadership and stakeholders

- Increased risk during audits and compliance reviews

- Difficulty meeting investor or board reporting requirements, critical for SaaS companies approaching IPO

3. Real-time visibility gaps

Static financial models don’t reflect current business reality. Without real-time synchronization, finance leaders operate with incomplete information and cannot track performance against strategic objectives as events unfold.

Impact on business:

- Missed opportunities for course correction

- Inability to provide accurate updates to stakeholders on demand

- Compromised cash flow forecasting and financial planning

How integration platforms enable financial reporting automation

iPaaS platforms address these challenges through four core capabilities that fundamentally transform how financial data moves through an organization. Unlike simple task automation tools, these platforms orchestrate complex, multi-system workflows with business logic, validation, and compliance controls.

1. Multi-system data orchestration

The foundation of automated financial reporting is the ability to connect and orchestrate data flows across multiple systems simultaneously.

What it solves: Eliminates manual data collection and consolidation

How iPaaS works:

- Connects your ERP and CRM with critical billing, revenue recognition, and FP&A systems through prebuilt connectors

- Automates bidirectional data flows between financial applications

- Synchronizes data in real time or on scheduled intervals based on business requirements

The technical approach:

- Complex workflow integration handles data transformation and mapping across systems

- Maintains data integrity through validation rules and error management

- Supports custom business logic for unique reporting requirements

The business outcome:

- Finance teams access unified, consistent data without manual intervention

- Time previously spent on data gathering is redirected to analysis and strategic planning

2. Automated data transformation and validation

Moving data between systems is only valuable if that data arrives accurately and in the correct format. This is where automated transformation and validation become critical.

What it solves: Ensures data accuracy and consistency across platforms

How iPaaS works:

- Automated field mapping between different system schemas

- Built-in data validation rules prevent errors before they propagate

- Standardizes data formats across multiple financial applications

The technical approach:

- Handles complex data transformations, including currency conversion, tax calculations, and revenue recognition rules

- Applies business rules consistently across all integrated systems

- Maintains audit trails for compliance and governance

The business outcome:

- Reduction in data entry errors

- Consistent financial data across all systems and reports

- Enhanced confidence in reporting accuracy for stakeholders

3. Real-time financial visibility

Perhaps the most transformative capability is the shift from periodic reporting to continuous, real-time financial insights.

What it solves: Provides current financial insights for strategic decision-making

How iPaaS works:

- Continuous data synchronization ensures financial systems reflect latest transactions

- Automated dashboards and reports update as data flows through integrated systems

- Event-driven workflows trigger updates based on specific business events

The technical approach:

- Real-time API connections between financial applications

- Incremental data syncs minimize processing overhead

- Exception handling ensures data integrity during high-volume periods

The business outcome:

- Finance leaders make decisions based on current data, not last week’s snapshot

- Ability to identify trends, risks, and opportunities as they emerge

- Enhanced agility in responding to market conditions

4. Compliance and governance automation

For finance leaders preparing for audits, IPOs, or managing regulatory requirements, automated compliance and governance capabilities provide essential safeguards.

What it solves: Streamlines audit preparation and regulatory compliance

How iPaaS works:

- Automated compliance checks validate data against regulatory requirements

- Complete audit trails track every data transformation and update

- Real-time alerts flag variances or compliance issues immediately

The technical approach:

- Built-in governance controls ensure data security and privacy

- Role-based access controls maintain proper data segregation

- Automated documentation of all integration workflows and data flows

The business outcome:

- Reduction in audit preparation time, according to Deloitte

- Reduced compliance costs

- Proactive risk management through early issue detection

Core financial reporting processes to automate

Understanding the capabilities of integration platforms is one thing. Knowing which specific processes to automate first is another. These four financial reporting processes deliver the highest return on investment and address the most common pain points finance leaders face.

1. Financial close acceleration

The month-end close process is often the most time-consuming and error-prone aspect of financial reporting. Automation can dramatically reduce both the time and risk involved.

Current challenges:

- Manual reconciliation between GL accounts, subledgers, and external systems.

- Journal entry creation requires data from multiple sources.

- Revenue recognition rules demand complex calculations across billing and accounting systems.

Automation approach:

- Integrate your ERP with billing, revenue recognition, and banking systems.

- Automate journal entry creation based on predefined rules.

- Synchronize revenue recognition data across financial platforms.

Measurable impact:

- Faster financial close

- Reduced errors in period-end reconciliations

- Finance teams focus on variance analysis rather than data preparation

2. Multi-entity financial consolidation

Organizations with multiple subsidiaries or business units face particularly complex reporting requirements. Automation can simplify what is traditionally one of the most challenging aspects of corporate finance.

Current challenges:

- Multiple subsidiaries or business units face complex consolidation requirements.

- Currency conversions, intercompany eliminations, and varying accounting standards create complexity.

- Manual consolidation processes delay corporate reporting.

Automation approach:

- Connect subsidiary ERPs with your corporate consolidation platform.

- Automate currency conversion and intercompany elimination calculations.

- Standardize data formats across entities amongst different systems for consistent data output.

Measurable impact:

- Accelerated consolidated reporting timelines

- Improved accuracy in multi-entity financial statements

- Enhanced visibility into subsidiary performance

3. Real-time management reporting

Modern business leaders need current data to make informed decisions, yet traditional reporting cycles create information gaps that can last weeks.

Current challenges:

- Leadership requires current financial performance data for strategic decisions.

- Traditional monthly reporting cycles don’t support agile business management.

- Ad-hoc reporting requests are time sinks for finance teams.

Automation approach:

- Integrate operational systems (CRM, ecommerce, billing) with financial reporting tools.

- Create automated dashboards that update as transactions occur.

- Enable self-service reporting for business leaders through unified data.

Measurable impact:

- Improved decision-making capabilities through automation

- Leadership accesses current KPIs without waiting for monthly reports

- Finance teams shift from report creation to strategic advisory

4. Regulatory and investor reporting

For SaaS companies preparing for IPO or managing private equity relationships, the stakes for accurate and timely reporting couldn’t be higher.

Current challenges:

- Public companies, IPO candidates, and private equity-backed firms face strict reporting requirements.

- Manual data gathering for regulatory filings introduces the potential risk of human error.

- Investor reporting demands accuracy and timeliness.

Automation approach:

- Integrate all financial data sources with reporting and compliance platforms.

- Automate data validation against regulatory requirements.

- Create audit-ready documentation through complete data lineage.

Measurable impact:

- Reduced compliance-related costs and risks

- Faster response to investor information requests

- Enhanced confidence in external financial communications

Implementation approach for financial reporting automation

Knowing what to automate is important, but understanding how to implement automation successfully is equally critical. A structured approach ensures you deliver value quickly while building toward comprehensive automation.

1. Assessment and planning

Before implementing any automation, take time to understand your current state and define clear objectives.

During this stage, start with pain points that will deliver immediate value, like the month-end close. Consider reporting requirements for upcoming business events like audits, fundraising, or IPO. And, importantly, involve both finance and IT stakeholders during planning.

Key steps:

- Identify highest-impact reporting processes for initial automation.

- Map current data flows between financial systems.

- Define success metrics, such as time savings, error reduction, and reporting cycle time.

2. Phased implementation

Rather than attempting to automate everything at once, a phased approach reduces risk and allows teams to build expertise incrementally.

A phased approach demonstrates value quickly while building towards more comprehensive automation. It allows teams to adapt new processes incrementally and reduces business disruption.

Recommended approach:

- Foundation Phase: Connect core financial systems (ERP, GL, banking).

- Expansion Phase: Integrate operational systems (CRM, billing, revenue recognition).

- Optimization Phase: Add advanced reporting, forecasting, and analytics capabilities.

3. Success measurement

Automation should deliver measurable business value. Track the key success metrics you’ve defined earlier to ensure your implementation achieves its objectives and identify opportunities for continuous improvement.

For continuous optimization, your team should:

- Monitor integration performance and data quality.

- Refine workflows based on user feedback and business changes.

- Expand automation to additional reporting processes over time.

From manual reporting to strategic financial leadership

Financial reporting automation transforms finance from an operational function to a strategic partner. Finance leaders who embrace integration gain a competitive advantage through better insights and faster execution.

Next steps:

- Assess your current financial reporting processes to identify opportunities for automation.

- Evaluate integration platforms that support complex, multi-system workflows, not just task automation.

- Start with high-impact processes that deliver measurable business value.

Explore how Celigo’s integration platform automates financial reporting workflows across your technology stack.

Integration Insights

Expand your knowledge on all things integration and automation. Discover expert guidance, tips, and best practices with these resources.