Automation best practices and learnings from 700+ IT leaders

Automation demand is rising faster than IT teams can deliver.

Across ecommerce, manufacturing, SaaS, and services, IT leaders told us the same story. Most have already invested in integrations and workflow automation. Yet 64% of IT leaders say they can’t keep up with automation requests, and 72% cite fragmented tools as their top barrier to progress, signaling that automation is delivering ROI but not scaling fast enough.

Learning from automation trends and best practices—such as harnessing automation for scaling the business, expecting a few bumps along the way, and prioritizing ease-of-use when shopping for an automation platform—are key to managing this rising demand.

Celigo’s 2025 Intelligent Automation Benchmark Report shares three years of survey data from more than 700 IT leaders. Our surveys investigated top automation drivers, use cases, and future planning across industries.

Below are three data-backed learnings from the report.

1. Don’t limit automation as a way to reduce operational cost—it’s essential to scaling the business.

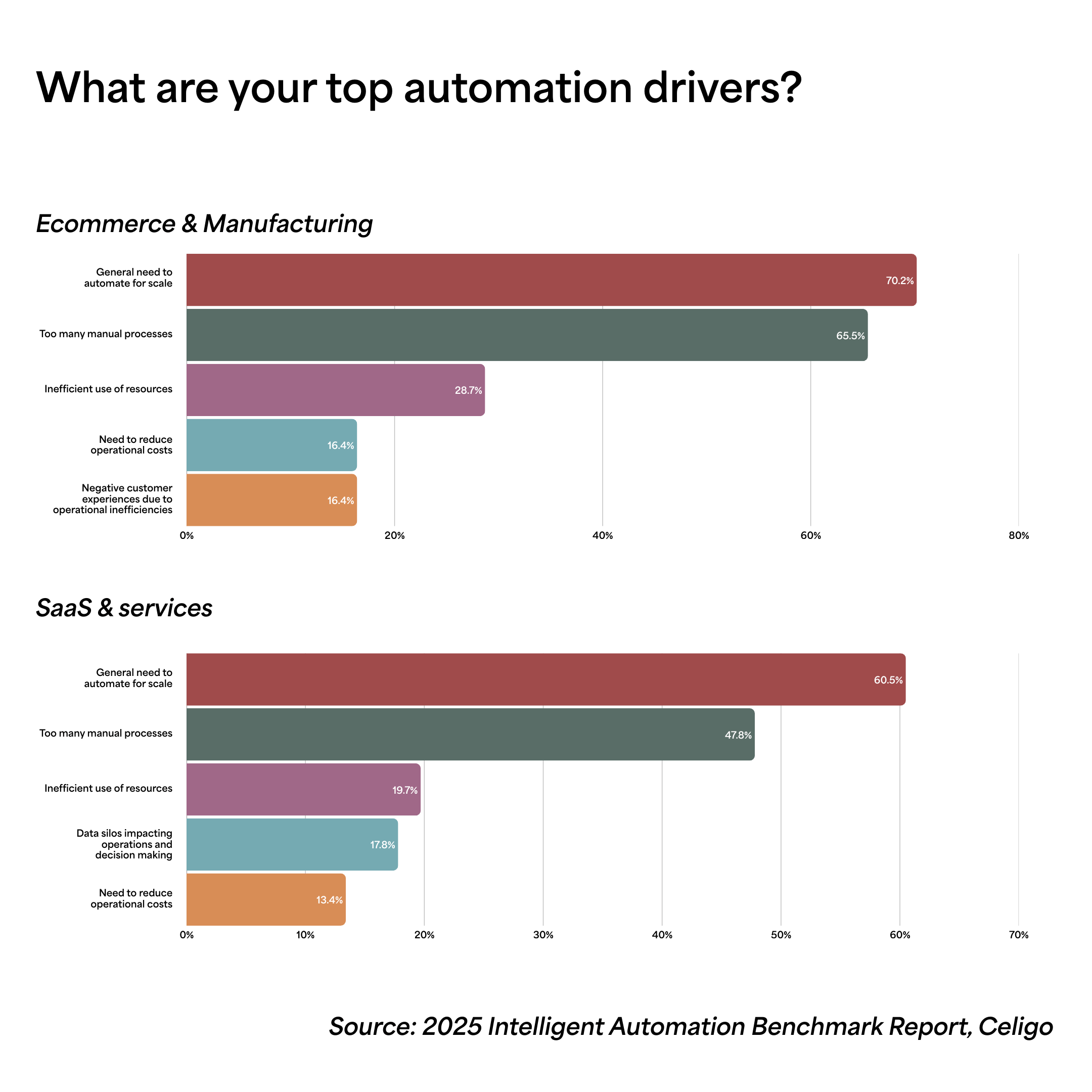

We asked respondents about their top automation drivers.

Leaders regardless of industry cited the general need to automate for scale as their top automation driver.

In contrast, reducing operational costs was only 16.4% for ecommerce and manufacturing teams, and 13.4% for SaaS and services teams.

This response suggests an overall maturity in automation models. Over the past three years, product companies have moved from basic efficiency fixes toward automation that supports scale, faster fulfillment, and steadier operations.

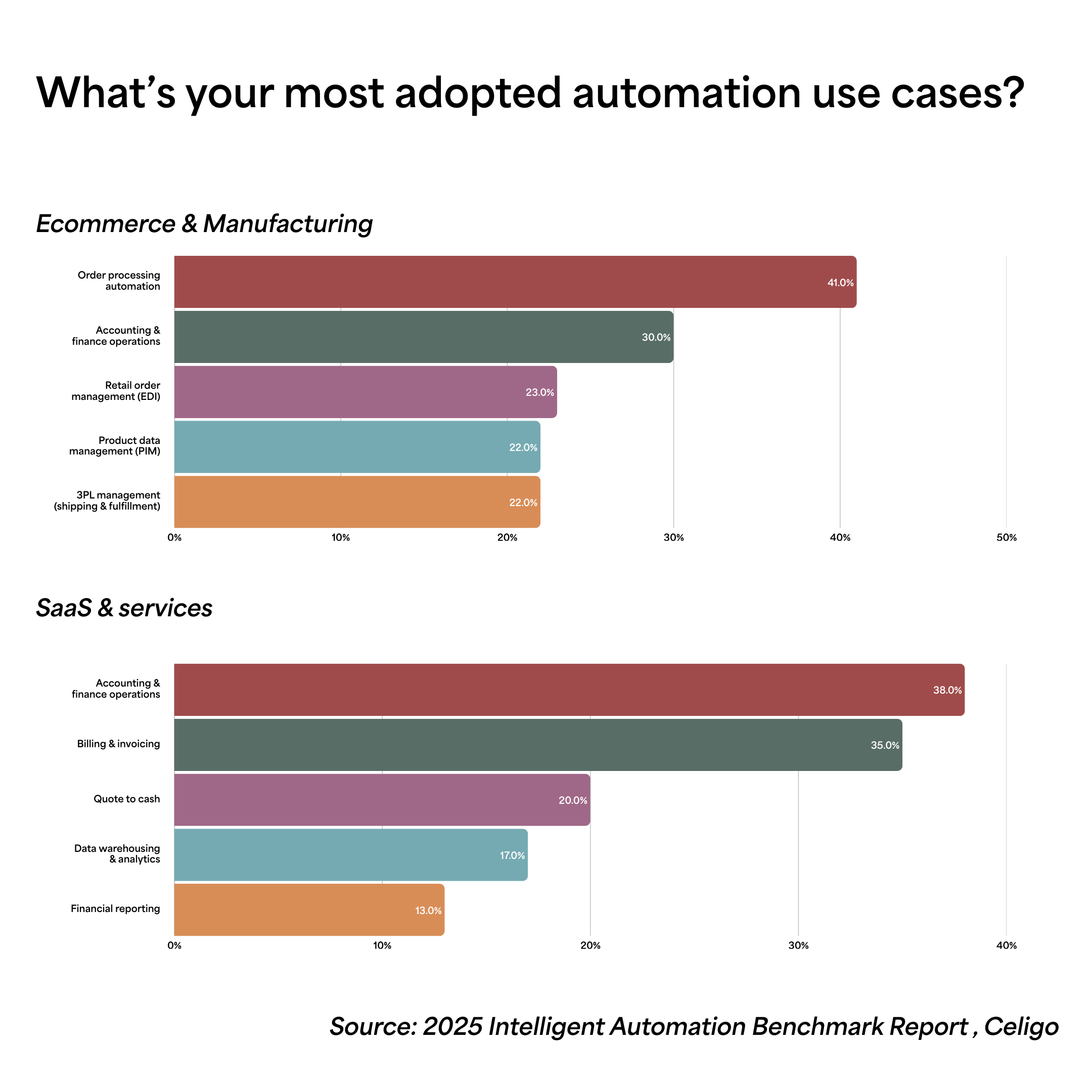

Outcome and adoption data reinforce this shift. Across both ecommerce and manufacturing, SaaS and services, the most widely automated use cases are end-to-end workflows such as: order processing, quote-to-cash, and billing.

These same organizations report gains in efficiency, accuracy, and scalability– suggesting that the strongest results come from automating cross-functional processes rather than isolated tasks.

These trends reflect market maturity. Automation is evolving from a back-office tool into a strategic enabler of business performance. Companies are no longer just automating to save time; they’re automating to see their business more clearly, act faster, and report with confidence.

2. Expect execution pain as a normal part of your automation journey.

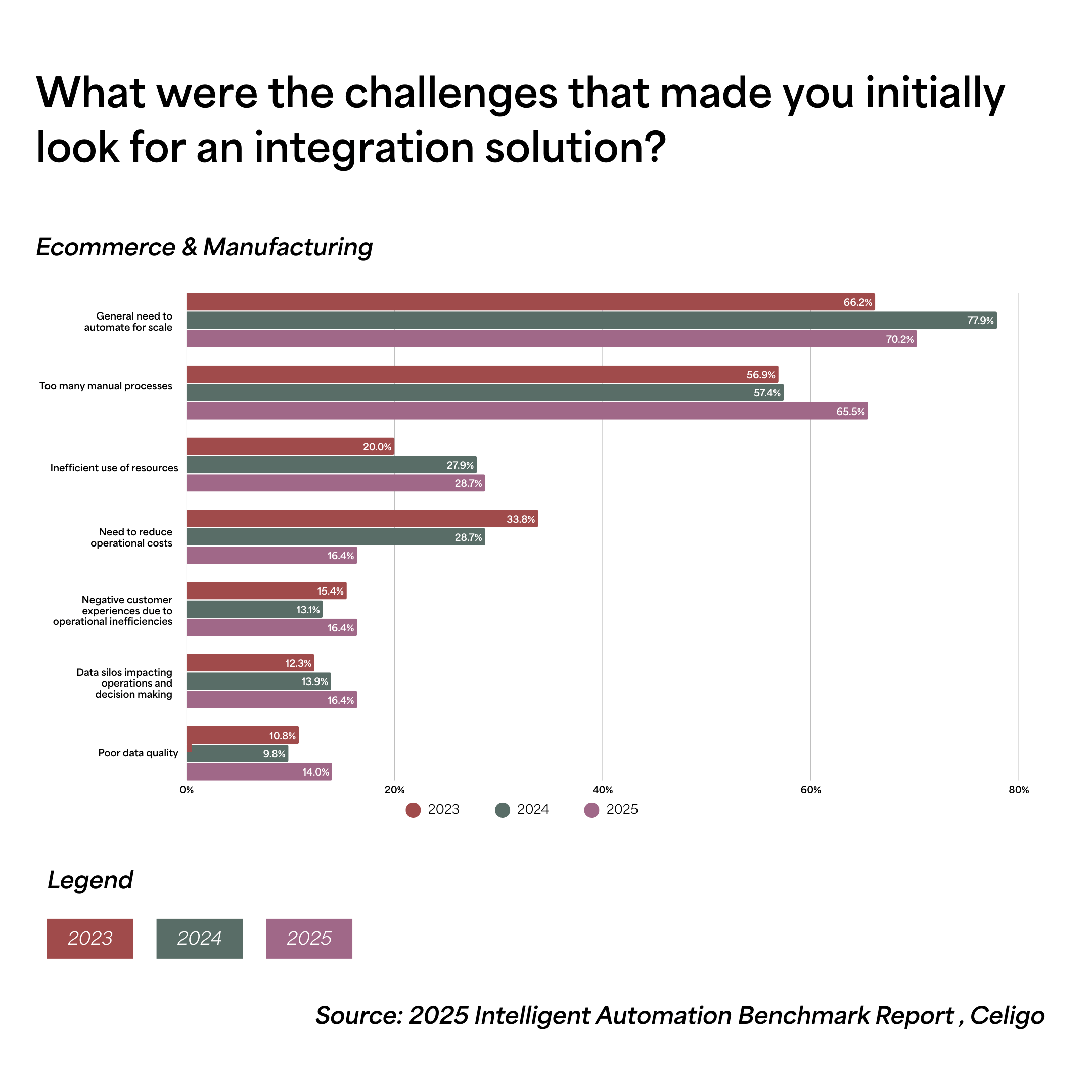

We asked IT leaders what challenges originally pushed them to look for an integration solution. Despite years of investment, the same execution pains keep surfacing—and in fact, they are getting worse.

In ecommerce and manufacturing:

- “Too many manual processes” increased from 56.9% to 65.5% over three years

- “Inefficient use of resources” rose from 20% to 28.7%

These increases of nearly 9-10% show that execution pain is not diminishing as automation spreads, but intensifying.

Ecommerce and manufacturing leaders can take action on the data by prioritizing automations that retire manual steps in order-to-cash, inventory sync, and returns. These remain the most persistent sources of friction for growth.

In SaaS and services, manual process pain stayed stubbornly high, declining only slightly from 58.2 percent to 47.8 percent. Even as teams automate, fragmentation across tools and ownership continues to constrain productivity, especially across revenue operations, billing, and service delivery.

In this segment, cost pressure has not disappeared. The need to reduce operational costs rose slightly from 12.3% to 13.4%.

For SaaS and services leaders, execution pain also increasingly shows up as visibility gaps. As workflows span CRM, ERP, billing, and support systems, automation must connect insight to action, not just move data from one place to another.

It would be a mistake to look at these numbers and conclude that automation isn’t working. It’s that automation is spreading faster than teams can manage. When automation demand expands across every department, an IT-only delivery model contributes to growing backlogs, fragmented systems, and governance gaps.

Future-oriented IT leaders and business teams alike need platforms that are powerful enough to manage enterprise complexity yet intuitive enough for anyone to use.

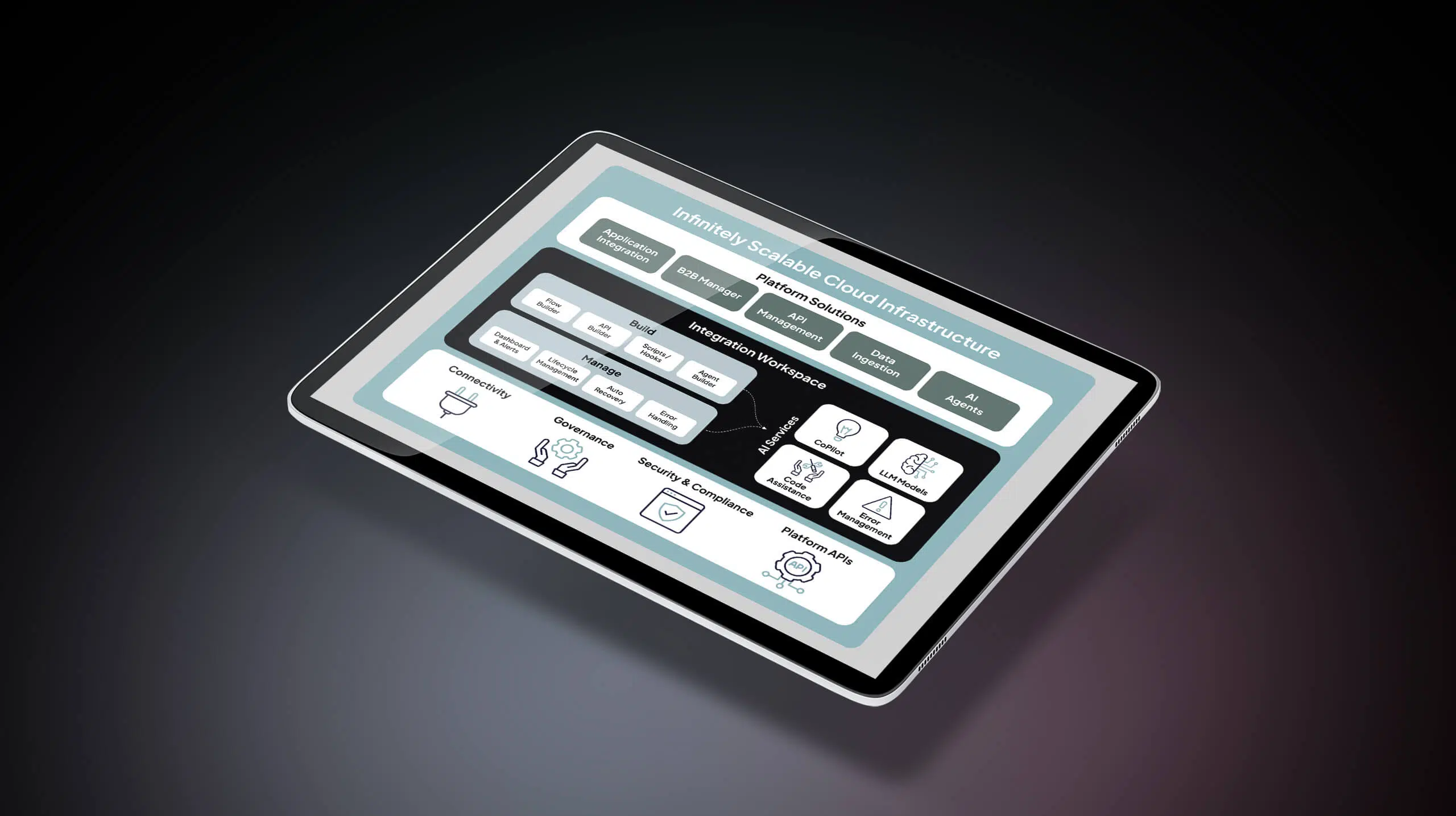

Celigo’s practical guide to integration technologies shares a 5-dimension evaluation framework based on Gartner’s Integration Maturity Model that you can use to compare integration platforms that can truly scale.

3. Prioritize ease-of-use when buying an automation platform.

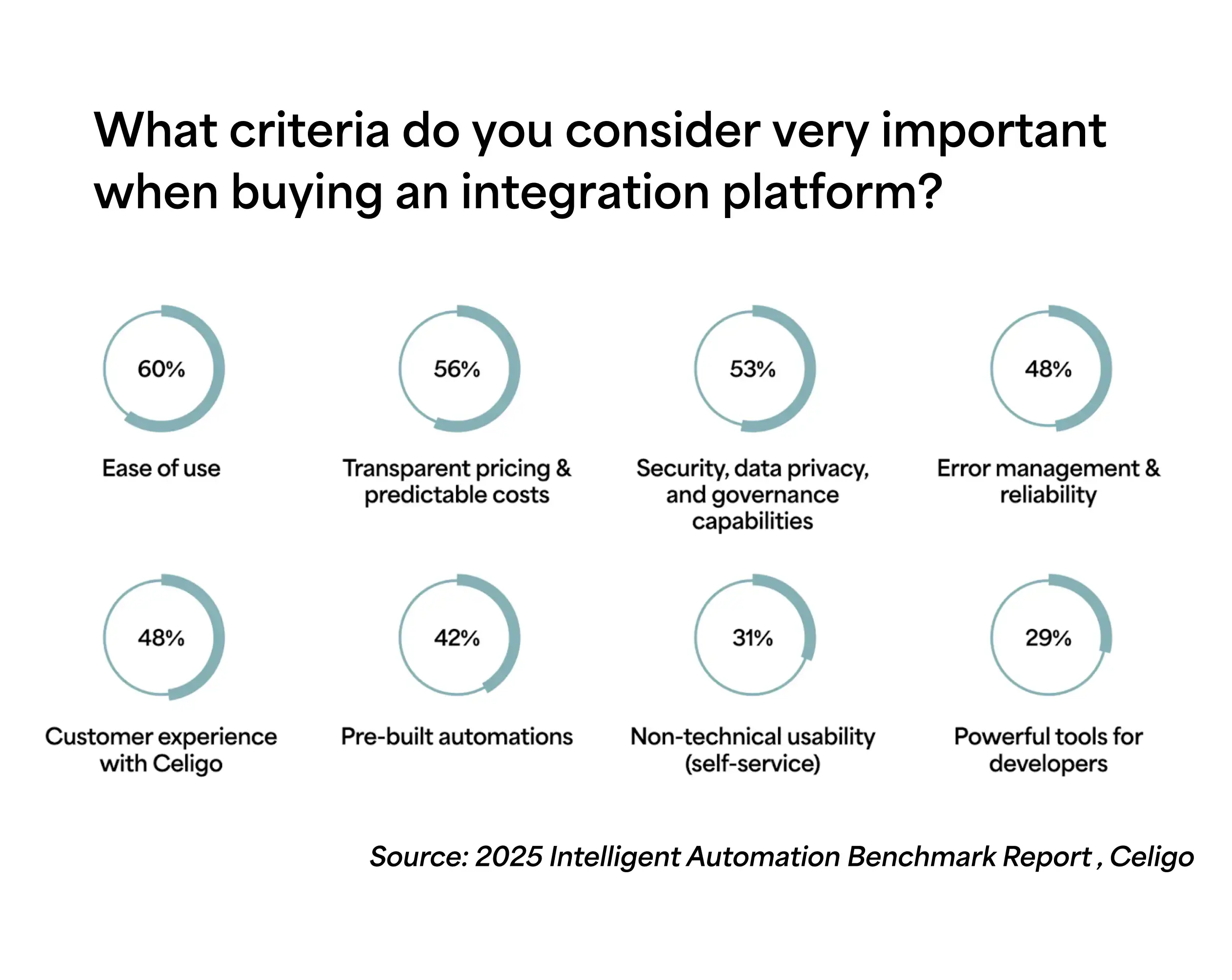

As automation becomes central to operations, buying criteria are evolving. The new standard is clear: automation must be secure, scalable, and accessible all at once.

According to our 2025 surveys, buyers prioritize usability, trust, and transparency when evaluating integration platforms.

Buyers need a platform that balances enterprise-grade control with consumer-grade usability. They’re seeking solutions that deliver fast time-to-value through prebuilt automation, maintain governance and visibility at scale, and offer pricing that grows predictably with the business.

According to our 2025 surveys, organizations using Celigo report clear gains in cost savings, scalability, and visibility. Companies that have succeeded don’t just see automation as an IT initiative, but a company-wide growth driver spanning finance, operations, and customer experience.

The most common outcome was improved efficiency and cost reduction (46%), as teams automate high-volume workflows, eliminate manual entry, and redirect time to higher-value work. Another 15% reported better data quality and visibility, driving more accurate forecasting and decision-making.

Scaling smarter starts with the right benchmarks

Across ecommerce, SaaS, manufacturing, and services, we saw leaders treat scaling automation as a priority.

Read the full 2025 Intelligent Automation Benchmark Report to go deeper into industry-specific trends, use cases, and maturity insights.